|

Accounting Software for LandlordsOur dedicated Landlord module is suitable for private Landlords with one or more UK rental properties. Get ahead of the new Making Tax Digital (MTD) changes due to take effect in 2026. We’ll provide you with all the tools you need to manage your tenants, recurring rent demands, expenses and Tax Filings. One Moment..

|

Key Points

| Easy Tenant Management |

| Add your tenants, assign them to your rental properties and generate recurring rent demands. Track your deposits received, tenancy periods and payment reconciliation. |

|

| Digital Recordkeeping |

| Start digitising your accounting records today, ready for the rollout of Making Tax Digital (MTD) for ITSA in 2026. Assign expenses to specific properties and monitor your profitability. |

|

| Making Tax Digital Ready |

| Obtain a near real time view of your tax position. QuickFile are ready for Making Tax Digital (MTD) and will allow you to file all your Tax Information from one platform. |

How can QuickFile help?

We have over 10 years of experience building accounting software for freelancers and small businesses owners. QuickFile is already used by many Landlords to manage one or more rental properties. More recently we have extended our tooling for landlords in readiness for the new Making Tax Digital updates scheduled for April 2026.

We can provide free accounting software for small to medium-sized users along with a powerful feature set for larger or more complex businesses. Our Power User subscription is just £6 per month*. For practices we have a dedicated multi-user platform called Affinity.

QuickFile can help you streamline your accounts in the following ways:

|

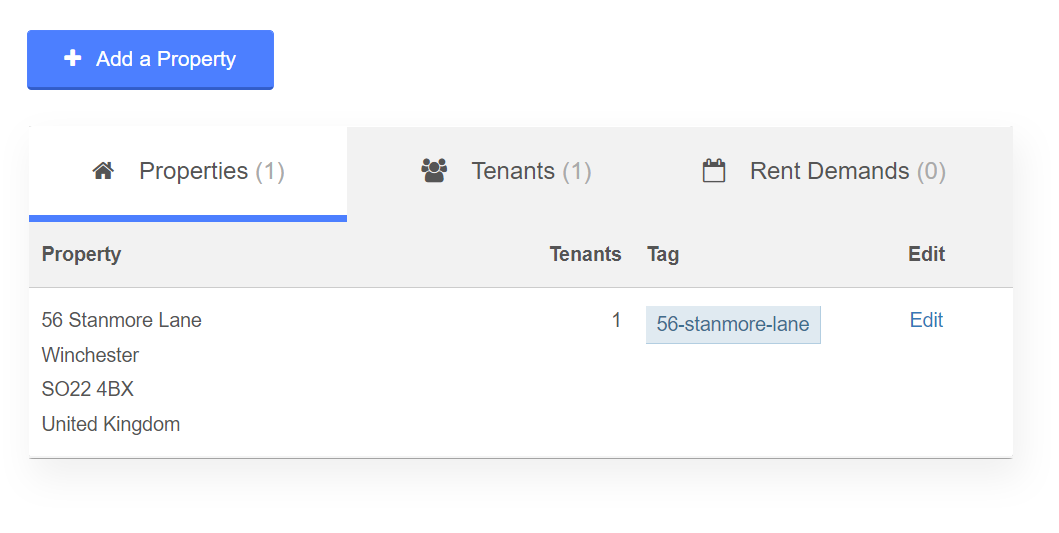

Landlord DashboardManage your properties, tenants and rent demands on a single dashboard. The Landlord Dashboard sits on top of the QuickFile core accounting system and simplifies the creation of your underlying client records, project tags and recurring invoices. |

|

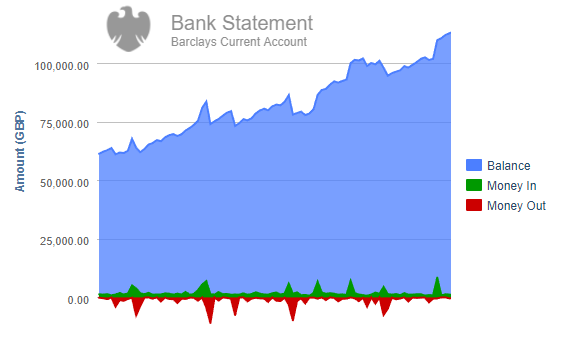

Automatic Bank FeedsQuickFile can link to your bank account and automatically import your transactions. This makes it simple to check your rental payments and track tenant liabilities. You can also tag your property expenses and configure rules to automate all aspects of bank reconciliation. |

|

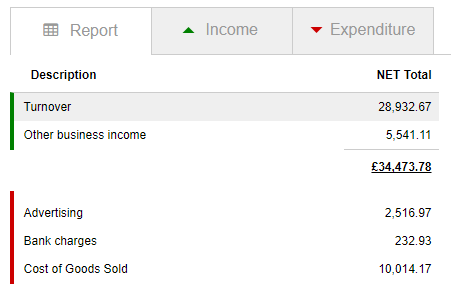

Intelligent ReportingQuickFile provide all the standard reporting tools you’d expect in an accounting software package, along with additional project management tools so you create per-property income and expenditure reports. QuickFile is MTD ITSA ready, so when the time comes you'll be able to file your quarterly summaries and end of year Tax submissions. |

|

Receipt DigitisationKeep on top of your property expenses with our iOS or Android App. You can snap your receipts on the move and either code them directly on the app, or have them posted into the Receipt Hub (our native receipt digitisation tool). You can also bulk import receipt scans directly from Dropbox. |

|

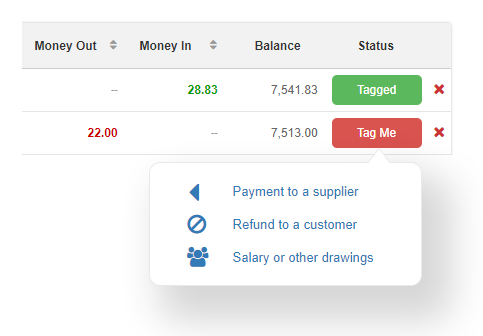

Powerful Bank TaggingBank Tagging allows you to import your bank transactions and create all your backing invoices using a simple, intuitive tagging wizard. You can tag individual items or isolate groups of up to 50 related items and bulk tag in one go. Bank tagging can save hours of manual reconciliation. |

Getting Started

To take the first step and get your business or accounting practice ready for Making Tax Digital for Income Tax and Self-Assessment, please choose from one of the following options: