|

VAT Bridging SoftwareAre you looking for a dedicated VAT Bridging solution to compliment your existing accounting software? We provide a simple to use Making Tax Digital (MTD) VAT Bridging tool for businesses that require a HMRC compliant way to submit their VAT Returns. |

Key Points

| Configure |

| Upload your bespoke Excel or CSV report. Your VAT Return totals will be automatically imported based on your custom rules. |

| Review |

| Preview your VAT Return box 1 to 9 totals. We'll check for any obvious errors and attach a copy of your backing report to the VAT Return. |

| Submit |

| When you’re ready QuickFile can submit your VAT Return directly to HMRC using the Making Tax Digital gateway. |

Simple Cost Effective Solution

Would you like to try the software first? You can file your first VAT Return free of charge. The VAT Bridging Module is included at no additional cost on the Power User Subscription and the Affinity Service (For bookkeepers and accountants).

- Power User Subscription: £60 + vat per year.* [more info]

- Affinity Account: From £1.27 + vat per month, per managed company. [more info]

|

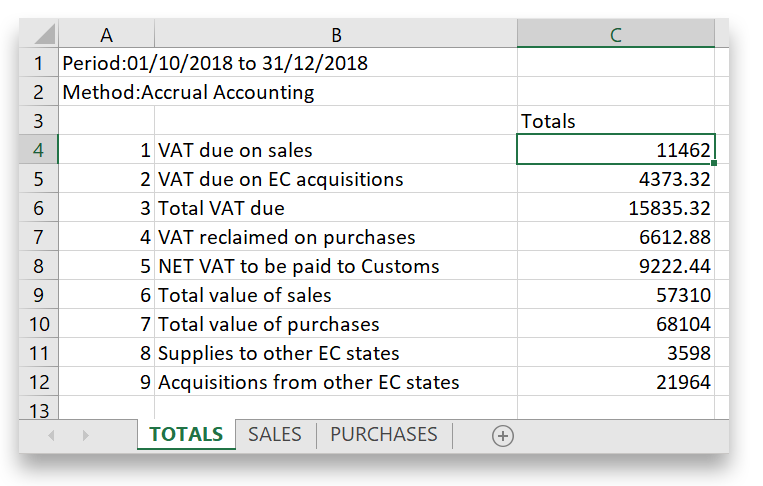

Simple Mapping ProcessBefore you get started with the VAT Bridging Module we first need to understand the layout of your VAT backing report. We allow you to configure the exact location on your spreadsheet where the VAT box 1 to 9 totals can be found, this includes sheet name, row number and column reference. Once you’ve saved the mapping locations they can be reused for all your future VAT returns. |

|

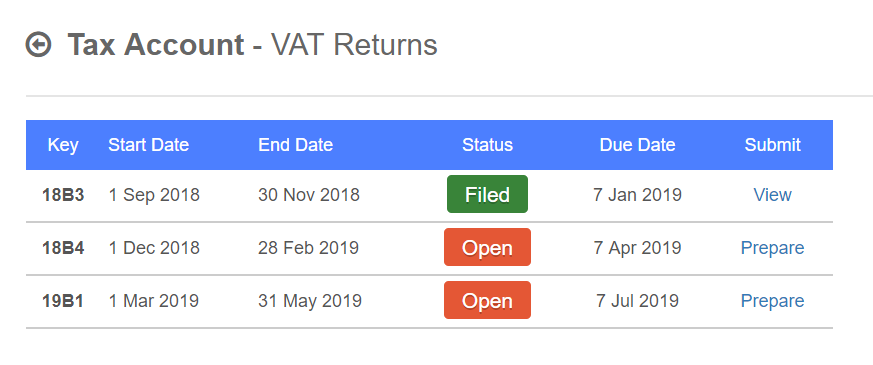

Real-Time ReportingWe connect directly to HMRC to show your real time VAT liabilities, payments and filing periods. We will also show you your historic VAT returns filed under the Making Tax Digital system. |

|

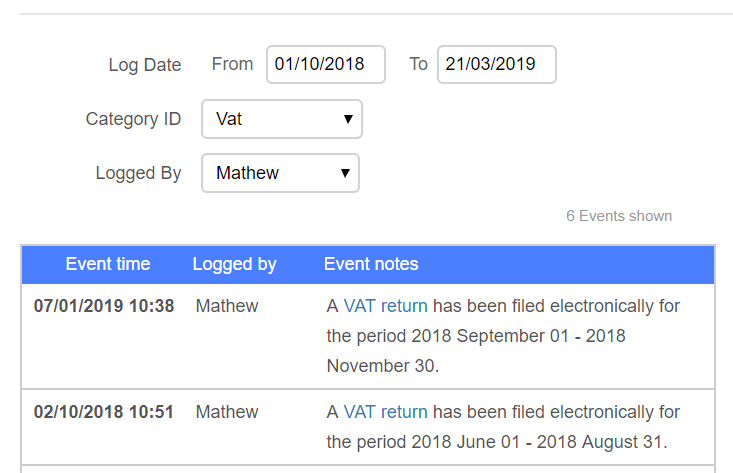

Clear Audit TrailWe will attach your backing report to your VAT Return for future reference. This makes it easy to locate all the necessary audit information when required. QuickFile has a comprehensive audit log to record exactly when your VAT Returns are submitted and the corresponding receipt credentials from the HMRC gateway. |

Getting Started

To take the first step and get your business or accounting practice ready for Making Tax Digital, please choose from one of the following options: